August 2025 Market Recap

Last Month in the Markets: August 2025

What Happened in August?

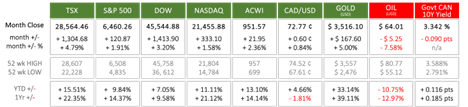

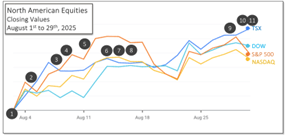

The TSX was the standout performer among North American equity indexes last month, rising nearly 5% above its July close. Not only did it outperform the S&P 500, Dow, and NASDAQ in August, but it also leads all of them in year-to-date and one-year performance. This strong performance came despite the threats and imposition of tariffs by the U.S. administration and a relatively muted response from the Canadian government

Key Economic and Geopolitical Events That Influenced Markets

1. August 1st – Trump’s Tariffs Imposed

At the beginning of the month, the U.S. imposed 35% tariffs on Canadian imports as trade negotiations stalled. At the time, there was no ongoing dialogue between Prime Minister Carney and President Trump. Prime Minister Carney has since indicated that negotiations will resume when appropriate.

Additionally, the U.S. Employment Situation Summary released on the same day was disappointing, prompting President Trump to dismiss the Chief Statistician at the Bureau of Labor Statistics. The report’s weakness also fueled expectations for an interest rate cut, which the president has been publicly advocating.

2. August 5th – Trade Deficits Shift

Canada’s trade deficit widened to $5.9 billion, its second-highest monthly level, as imports—particularly high-value oil equipment—grew faster than exports. Notably, exports to the U.S. fell to 70% of total exports, down from 83% in June 2024.

In contrast, the U.S. trade deficit shrank 16% to $60.2 billion, the lowest in two years, as both exports and imports declined, especially imports from China and consumer goods.

3. August 7th – China Skirts U.S. Tariffs

China’s exports increased 7.2% in July compared to the previous year. Although direct shipments to the U.S. dropped by over 20%, exports surged to countries that often re-route Chinese goods to the U.S., helping China maintain overall growth.

4. August 8th – Canadian Employment Drops, U.S. Inflation Rises

Canada lost 41,000 jobs in July, with the unemployment rate holding at 6.9%. The decline was led by youth employment and sectors like information, culture, recreation, and construction.

Meanwhile, U.S. consumer prices rose, with core CPI increasing 0.3% for the month and 3.1% year-over-year—its fastest pace in five months. This raised concerns that inflation could continue to rise due to delayed effects of the tariffs.

5. August 11th – China Tariffs Delayed

President Trump granted a 90-day delay on 145% tariffs on Chinese imports, while China postponed retaliatory tariffs of 125%. Existing tariffs of 30% on imports from China and 10% on U.S. exports remain in place.

6. August 12th – U.S. Inflation and Interest Rate Outlook

Inflation data showed rising prices, yet many analysts believe the weak job market will push the Federal Reserve to cut interest rates. As of the CPI release, the CME FedWatch Tool showed a 94% probability of a rate cut at the upcoming September 17th meeting.

7. August 14th – Producer Prices Jump

The U.S. Producer Price Index (PPI) rose 0.9% in July—the largest monthly increase in several months—bringing the year-over-year rate to 3.3%, the highest since February.

8. August 15th – Trump and Putin Meet in Alaska

President Trump met with Russian President Vladimir Putin in Alaska to discuss the ongoing war in Ukraine. Ukrainian President Volodymyr Zelenskyy was notably not invited. NATO and EU leaders strongly criticized the exclusion, and no significant progress from the meeting has been reported.

9. August 28th – U.S. GDP Revised Upward

U.S. GDP growth for Q2 was revised up to 3.3%, from an initial estimate of 3.0%. A drop in imports following pre-tariff stockpiling helped boost the final figure.

10. August 29th – Canadian Economy Contracts

Statistics Canada reported that GDP declined by 0.4% in Q2, following a 0.5% gain in Q1. The decline was driven by a 7.5% drop in exports and reduced business investment in equipment. Uncertainty created by U.S. tariffs and Canada’s limited response contributed to the economic slowdown.

11. August 29th – U.S. Inflation Remains Elevated, Tariffs Challenged

The U.S. PCE inflation index, the Federal Reserve’s preferred gauge, rose 2.6% year-over-year, with core inflation at 2.9%—both above the Fed’s 2% target. A federal appeals court ruled that President Trump’s tariffs were illegal, though they remain in place pending a possible appeal to the U.S. Supreme Court. Despite the complex economic backdrop, the probability of a rate cut on September 17th remains high.

Looking Ahead for September and Beyond?

Key decisions from the Bank of Canada and the U.S. Federal Reserve are expected on September 17th. Canadian inflation remains near the 2% target, but job growth has stalled. In the U.S., inflation is above target, but slowing job growth may compel the Fed to act. As of Labour Day, market expectations indicate a roughly 90% chance of a rate cut.

With trade tensions still high, inflation likely to rise, and employment growth slowing, market uncertainty will continue. The legality of U.S. tariffs now rests with the Supreme Court, and any ruling could further shift the economic landscape in October.

Meanwhile, Canadian and American leaders are continuing trade talks, with a formal CUSMA review scheduled for July 2026. Interest rate decisions and trade negotiations will remain dominant themes influencing market performance in the months to come.