September 2025 Market Recap

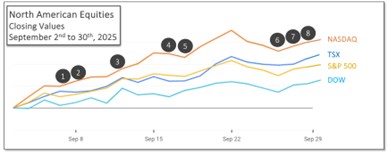

Last Month in the Markets: September 2nd – 30th, 2025

Last Quarter in the Markets: July 1st – September 30th, 2025

What Happened in Q3 and September?

Equity investors enjoyed strong performance over the past three months, including September. From an economic perspective, the month was relatively calm. Most conditions remained steady: employment stayed soft, inflation ticked higher, and central banks responded by cutting rates.

The absence of negative surprises supported an upward push in markets. Ongoing geopolitical turmoil did not worsen, but it did lift gold prices—up 10% in September and 17% for the quarter. Oil prices fell by 4% over the last three months. Bond yields also weakened as interest rates declined

Events that Influenced Markets in September Included:

1. September 5 – Canadian and U.S. Employment Reports Disappointed

Canada’s Labour Force Survey showed employment dropped by 66,000 in August after falling 41,000 in July. The August decline was mostly in part-time work (-60,000), while full-time employment held steady after July’s decline of 51,000.

In the U.S., nonfarm payroll employment increased by only 22,000 in August and has shown little change since April. During the first five months of 2025, U.S. job growth averaged 168,000 per month, including 228,000 in March, before the announcement of tariffs in April.

2. September 5 – Prime Minister Carney Announced an Economic Recovery Plan

The Prime Minister outlined measures to strengthen the Canadian economy, reduce reliance on the U.S., and broaden international trade.

3. September 11 – U.S. CPI Remained Above Target

The Consumer Price Index (CPI) rose in August. Year-over-year inflation reached 2.9% compared with 2.7% in July. On a monthly basis, CPI increased 0.4%. Core CPI, which excludes food and energy, grew 3.1% annually and 0.3% for the month.

4. September 16 – Canadian CPI Edged up in August

Canada’s CPI increased 1.9% year-over-year in August, compared with 1.7% in July. On a monthly basis, CPI slipped by 0.1%.

5. September 17 – Bank of Canada and Federal Reserve Lowered Policy Interest Rates

With inflation under control but growth and employment weakening, the Bank of Canada cut its overnight policy rate by 25 basis points. It last adjusted rates on March 12, 2025. The Bank’s statement noted that Canada’s GDP fell about 1.5% in Q2, largely due to tariffs and trade uncertainty.

The U.S. Federal Reserve also lowered its federal funds rate to a range of 4.0% to 4.25%. Its statement said economic activity had moderated, job growth slowed, and inflation remained somewhat elevated.

6. September 26 – U.S. PCE Confirmed Inflation Above Target

The Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, rose 2.7% in August year-over-year, up from 2.6% in July. The modest increase is unlikely to alter the Fed’s policy path. Earlier in September, the Fed indicated that two additional rate cuts were possible this year.

7. September 26 – GDP Rebounded in Canada and the U.S.

Canada’s GDP grew 0.2% in July, the first increase in four months. U.S. GDP expanded at an annualized rate of 3.8% in Q2, according to the BEA’s third estimate.

8. September 30 – U.S. Government Shut Down Amid Budget Battle

The U.S. government shut down at midnight when funding expired without a replacement budget bill. Despite the political turmoil, the S&P 500 reached a new record as investors bet the shutdown would be short-lived.

What’s ahead for October and beyond?

The U.S. government shutdown and central bank policy decisions will likely dominate market sentiment for the rest of the year. Political disputes in Washington could create uncertainty beyond short-term funding bills, especially if the shutdown extends and disrupts federal operations.

Democratic objections appear to reflect broader dissatisfaction with Trump administration policies. Meanwhile, the Republican-controlled House and Senate failed to pass spending bills, despite votes before and after the shutdown began. As of October 1, consensus expectations pointed to a two-week closure, which aligns with the historical average since 1990.

The Bank of Canada and the Federal Reserve have two remaining policy announcements this year, scheduled for October 29 and December 10. Markets widely expect further cuts. On October 1, futures markets placed the probability of a U.S. rate cut on October 30 at 100%.

Finally, the trade war initiated by President Trump continues and is expected to overlap with the renegotiation of the Canada–U.S.–Mexico Agreement (CUSMA) in early 2026. CUSMA, which replaced NAFTA during Trump’s first presidency, includes a scheduled review. Recent meetings between Canada and Mexico suggest they may coordinate strategies to strengthen their negotiating position with the U.S