2025 Market Review & 2026 Market Outlook

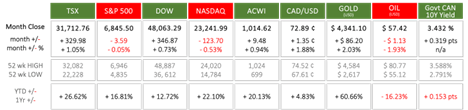

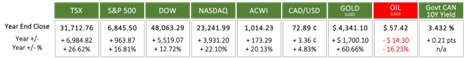

Last Month in the Markets: December 2025

Last Year in the Markets: January 1st – December 31st, 2025

What happened in 2025?

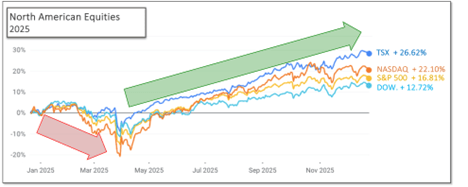

Last year was again productive for equity investors, with Canadian and U.S. indexes delivering strong returns for the third consecutive year. However, the year was not smooth throughout. The first quarter struggled until President Trump held an Independence Day–themed ceremony from the White House Rose Garden on April 2. Rather than the traditional July 4 celebration featuring red, white, and blue bunting and parades, he announced a sweeping set of tariffs that ignited a global trade war.

By Friday, April 4, North American equity indexes had plunged between 6.32% and 10.02% for the week. The All-Country World Index declined 7.91% over the same period, highlighting the depth and breadth of the tariffs’ negative impact on global equity markets. Fortunately, by mid-May, the TSX, S&P 500, Dow, and NASDAQ had fully erased the losses incurred during the first week of April

Delays in implementing tariffs on U.S. imports allowed markets to calm, and negative financial effects were postponed. When other nations—particularly China—threatened retaliatory tariffs on U.S. exports, when countries increased American access to their markets, or when foreign leaders delivered concessions to the President, previously announced tariffs were cancelled, reduced, or delayed.

The VIX Index, which measures market volatility and signals fear and stress, peaked on April 4. The VIX has only peaked higher twice: in October 2008 during the global financial crisis, and in March 2020 at the onset of the global pandemic. Equities and the VIX are inversely correlated, meaning they typically move in opposite directions. Thankfully, the VIX has since returned to levels that indicate greater market stability. From the VIX’s peak and equities’ trough in early April, the two moved in opposite directions, with equity indexes reaching all-time highs later in 2025.

The geopolitical uncertainty that underscored President Trump’s trade war drove some investors toward gold as a haven, pushing its price to an all-time high and resulting in gains of more than 60% in 2025. At the same time, perceived and actual declines in global economic growth reduced demand for oil, leading prices to fall more than 16% over the year and close below $58.

What’s ahead in 2026?

The uncertainty and volatility experienced in 2025 will likely continue, but it is difficult to imagine that a single event on a single day—such as President Trump’s tariff announcements in early April—could be repeated with the same immediate and lasting effects. Regardless of political stance, interpreting political and economic events through the lens of individual financial goals remains the core purpose of investment management.

As always, monetary policy will play a significant role in influencing capital markets and will be guided by inflation and employment data and trends. Additional attention will follow developments surrounding Federal Reserve Chair Jerome Powell, who is under investigation for allegedly misleading Congress. It does not appear that he will subject himself to partisan political pressure based on his response to the emerging case.

The end of January will mark the beginning of 2026 in earnest, as the Canadian and U.S. central banks make interest rate decisions on the same day. The Bank of Canada and the Federal Reserve will both announce rate decisions on January 28, March 18, April 29, October 28, and December 9. On June 10, July 15, and September 2, the Bank of Canada will announce its decisions one to two weeks ahead of the Federal Reserve’s scheduled rate dates.

As each announcement approaches, markets will price in the anticipated monetary policy move. Unexpected decisions are likely to introduce volatility in equity markets, while well-telegraphed actions typically do not result in sudden or significant valuation changes.

Global and domestic gross domestic product (GDP), which measures economic output, will influence the price of oil, while geopolitical uncertainty tends to push the price of gold higher. These generally accepted relationships may experience exceptions, but they remain predictable based on historical patterns. It appears that much of the unpredictability ahead may stem from the actions and decisions of the U.S. Supreme Court, legislative bodies, and the presidency.

Since investing solely in guaranteed investment certificates (GICs) does not provide risk-free, after-tax returns that consistently outpace inflation, uncertainty is unavoidable. Managing risk in a manner consistent with individual circumstances, while maximizing returns within those constraints, remains the paramount consideration in investment decisions, goal-setting, and financial planning.

Summary of economic events that contributed to market performance in 2025:

1. January 10th– Employment rose dramatically to close 2024

StatsCan’s Labour Force Survey reported that Canadian employment rose by 91,000 in December. The unemployment rate declined slightly by 0.1 percentage points to 6.7%. The increase to was almost four times the amount anticipated by analysts and economists.

U.S. employment increased by 256,000 in December, which was 38% above the 2024 monthly average of 186,000. The unemployment rate remained constant at 4.1%, and the number of unemployed people did not change in December and sits at 6.9 million.

2. January 15th– U.S. CPI rose on energy prices

Consumer prices rose 0.4% in December, and the all-items index increased by 2.9% over the last year as reported by the U.S. Bureau of Labor Statistics. Over 40% of the month’s increase is attributed to energy prices.

3. January 17thChina’s economy grew rapidly in Q4

China’s economy expanded 5.4% in the fourth quarter, exceeding expectations. Full year GDP growth reached 5% as stimulus measures delivered results.

4. January 20th– Trump became President, again

Donald Trump was inaugurated as the 47thPresident of the United States in a ceremony on the Rotunda of the Capital Building. Within the first days of his presidency over one hundred executive orders were signed to further his agenda.

5. January 24th– Trump wasted no time in threatening tariffs

As of his first Friday after returning to office, Trump’s threatened tariffs had not materialized. A February 1 implementation date for 25% tariffs against Canada and Mexico imports has been repeatedly mentioned. In some statements tariffs are designed to facilitate the tightening of borders that permit drugs and illegal immigrants to enter the U. S.

President Trump has suggested that firms could relocate production to the U.S. to avoid paying tariffs, and that tariffs would generate revenue for the U.S. government.

6. January 29th– BoC cut rates to start the year

The Bank of Canada lowered its policy interest rate by 25 basis points, the U.S. Federal Reserve held rates steady, and the European Central Bank took the same decision as Canada.

7. January 31st– U.S. inflation remained above target

The U.S. Bureau of Economic Analysis released the Personal Consumption and Expenditures (PCE) price index, the Federal Reserve’s preferred inflation indicator. On a monthly basis headline PCE rose 0.3% and 2.6% on a year-over-year basis for December. Both figures were aligned with expectations and are above the Fed’s targets.

8. February 7th– Employment growth high in Canada, slowed in U.S.

StatsCan’s Labour Force Survey reported that employment increased by 76,000, which was triple the expectation of analysts. The unemployment rate fell by 0.1% to 6.6%. Wages for permanent employees have risen 3.7% on a year-over-year basis. Wage rate growth is closely watched by the Bank of Canada as a leading inflation indicator.

The U. S. Bureau of Labor Statistics released its Employment Situation Summary showing that nonfarm payroll rose by 143,000 in January. Unlike Canada, this is below the expectation of 169,000 and significantly less than December’s 307,000. The unemployment rate in January lowered slightly to 4.0%. The market has interpreted the less-than-stellar report as not weak enough to push the Federal Reserve back into rate cutting mode.

9. February 12th– U.S. inflation higher than expected

After rising 0.4% in December, the Consumer Price Index (CPI) increased 0.5% in January. Over the past 12 months the all-items index increased 3% before seasonal adjustment. About 30% of the month’s increase was attributed to the index for shelter. The energy index increased 1.1% , and gasoline rose 1.8%t in January adding to rising inflation. Equity values declined after the Bureau of Labor Statistics release. Rising prices suggest that the Federal Reserve will delay interest rate reductions until the second half of 2025.

10. February 21st– Fed minutes indicated inflation expectations

The Federal Reserve released the minutes from its January 28-29thmeeting that held interest rates steady. The committee noted that businesses would attempt to pass input cost increases to consumers arising from tariffs, and that inflation expectations had increased recently. The expectation for rising inflation continues to push the next Fed rate reduction further into the future, likely in the summer or autumn. A delay in rate cuts by the Fed placed additional negative pressure on stock values.

11. February 28th– Canadian GDP rose slightly, U.S. corporate results soared, PCE moderated

Canadian Gross Domestic Product (GDP) rose 0.2% in December after declining by the same proportion in November. Fourth quarter GDP increased 0.6% after rising 0.5% in the third quarter. Overall household spending rose 1.4% in the fourth quarter and 2.4% in 2024.

The quarterly earnings season concluded for S&P 500 companies with an average earnings gain of 17.8% over the same period one year ago. It was the strongest growth since the fourth quarter of 2021. Financials posted an earnings gain of 56%, the highest of all 11 sectors.

The U. S. Federal Reserve’s preferred inflation indicator, the Personal Consumption Expenditures price index (PCE) rose 2.5% in January and core PCE that excludes food and energy increased 2.6%. January’s performance was a slight improvement from December’s levels.

12. March 6th–ECB interest rates cut

The European Central Bank (ECB) cut its interest rates by 0.25% (25 basis points), which set its interest rates on the deposit facility, the main refinancing operations and the marginal lending facility at 2.50%, 2.65% and 2.90%, respectively.

13. March 7th-Canada and the United States released employment data for February

In Canada, employment was virtually unchanged (+1,000) and the unemployment rate held steady at 6.6%.

According to the Bureau of Labor Statistics (BLS), U. S. jobs rose by 151,000 in February, which was higher than expected, while the unemployment rate was unchanged at 4.1%. Wages have risen 4.0% over the last year. The latest U. S. jobs data suggests that the next Federal Reserve rate cut will occur in the second half of 2025.

14. March 12th– interest rates and inflation

The Bank of Canada reduced its target for the overnight rate again. The announcement included, “the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, Governing Council decided to reduce the policy rate by a further 25 basis points to 2.75%.”

U. S. consumer prices increased 0.2% in February, and on a year-over-year basis the all-items index increased 2.8% before seasonal adjustment. In January, the monthly inflation increase was 0.5%t, and the annualized inflation rate was 3.0%.

15. March 14th–New Prime Minister of Canada

On Friday, Mark Carney, former central banker, replaced Justin Trudeau as Prime Minister. Unrelated to this change, North American equity indexes rose for the second consecutive Friday.

16. March 19th– Federal Reserve interest rate announcement

The Federal Reserve kept U.S. interest rates steady. The statement included, “In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will consider a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.” The Fed is watching the effects of the Trump administration’s actions to impose tariffs and trade restrictions, and the resulting responses from sovereign nations affected by the trade war. The Fed will continue to maximize employment and return inflation to its long-run target of 2% even as “uncertainty around the economic outlook has increased.”

17. March 28th– U.S. inflation rose, Canadian GDP grew, and leaders talked

Equities initially moved lower again with the U.S. Bureau of Economic Analysis’ release of the Personal Consumption Expenditures price index (PCE), which is the Federal Reserve’s preferred inflation measure. Inflation for February was 2.5% and Core PCE, excluding food and energy, ticked higher than expected to 2.8% from one year ago. The uncertainty surrounding inflation and tariffs continues to linger and delay CME’s Fed Watch prediction of lower rates to June and July.

Canadian Gross Domestic Product (GDP) rose 0.4% in January, a slight increase over the 0.3% increase in December. 13 of 20 sectors rose with goods-producing sectors delivering the largest increase at 1.1% for the first month of 2025. Mining, quarrying, and oil and gas extraction provided the largest increase in January. The largest drag on growth occurred in the retail trade sector, which contracted 0.9%. Tariffs are affecting February growth, when GDP is estimated to be unchanged.

18. April 2nd– Trump launched global trade war

At a mid-afternoon press conference from the White House Rose Garden, Donald Trump imposed tariffs on imports from 185 countries and territories.

The calculation to determine the tariff rate is not an accepted practice used by economists and assumes that a trade deficit represents the sum of all unfair practices by the foreign counterpart. Trump stated that the calculation included currency manipulation and other barriers, but these factors are not included in the mathematical formula. A report from the Cato Institute, which is based on 2023 World Trade Organization data, calculates China’s trade-weighted average tariffs at 3%. Trump imposed a minimum tariff of 10% bypassing his own calculation, since it was applied on 115 countries that the U. S. has a trade surplus.

19. April 4th–Canadian employment dropped in March, rose in U.S.

Employment data was released in Canada and the U.S. for March. Stats Can determined Canadian employment fell by 33,000, the first decline since January 2022, the employment rate declined 0.2% and the unemployment rate rose 0.1% to 6.7%.

The total nonfarm payroll employment rose by 228,000 and the unemployment rate changed little as reported by the Employment Situation Summary from the U.S. Bureau of Labor Statistics. Job gains were made in health care, social assistance, transportation and warehousing, and retail trade. Federal government employment declined.

20. April 10th– U.S. inflation fell slightly

In more encouraging news, the U.S. Bureau of Labor Statistics announced that the Consumer Price Index (CPI) rose 2.4% in March on a year-over-year basis. The same measure one month ago was 2.8%. Core CPI that excludes more volatile food and energy was also 2.8%, which is its lowest level in four years.

21. April 15th– Canadian consumer inflation dipped lower

StatsCan announced that the Consumer Price Index (CPI) for March was 2.3% on a year-over-year basis, down from 2.6% in February. The slowdown in price increases was driven by lower prices for travel and gasoline in March.

22. April 16th– Bank of Canada held rates steady, and ECB dropped¼ point

The Bank of Canada maintained its target for the overnight rate at 2.75% and released its Monetary Policy Report (MPR). Tiff Macklem, Bank of Canada Governor, indicated that the “dramatic protectionist shift in US trade policy and the chaotic delivery have increased uncertainty, roiled financial markets, diminished global growth prospects and raised inflation expectations” in his opening statement to announce the rate decision.

23. April 28th– Canada re-elected Liberals and Prime Minister Mark Carney

At the end of the five-week campaign the Liberals won 169 seats, 3 short of the number needed to obtain a majority government. The official opposition will be the Conservatives with 144 seats.

24. April 30th–American and Canadian Gross Domestic Product (GDP) declined

Canadian real GDP was 0.2% lower in February, following a 0.4% increase in January. Goods producing industries fell 0.6%, services-producing industries slipped 0.1% in February. Mining, oil and gas extraction, construction, real estate, rental and leasing declined while durable goods, finance and insurance rose.

American GDP decreased at an annual rate of 0.3% in the first quarter of 2025 as reported by the advance estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2024, real GDP increased 2.4%.

25. May 2nd– U.S. economy contracted in Q1, and job growth remained strong in April

American GDP decreased at an annual rate of 0.3% in the first quarter of 2025 as reported by the advance estimate released by the Bureau of Economic Analysis. For reference, in the fourth quarter of 2024, real GDP increased 2.4%.

U. S. nonfarm payroll employment increased by 177,000 in April and the unemployment rate was unchanged at 4.2% as reported by the Bureau of Labor Statistics ‘press release.

26. May 12th– Temporary truce between U.S. and China sent stocks soaring

U.S. tariffs on most Chinese goods have been reduced to 30% and China has reduced its tariffs on most U.S. goods to 10%. The size of the cuts to the proposed tariffs, on both sides, and the speed of the agreement contributed to the size of the surprise and the size of the increase for equity indexes.

27. May 13thand 14th– Positive inflation news contributed to equities rally

According to the Bureau of Labor Statistics, over the last 12 months, the all-items Consumer Price Index (CPI) increased 2.3% before seasonal adjustment.

U. S. Producer Price Index fell 0.5% in April after being unchanged in March and increasing 0.2% in February. On an unadjusted basis, the index for final demand rose 2.4% for the 12 months ended in April.

28. May 16th– Moody’s downgraded U.S. government credit rating

The U.S. government had its creditworthiness rating downgraded by Moody’s, which followed the same conclusion reached previously by S&P Global ratings in 2011 and Fitch Ratings in 2023. Moody’s had held a perfect rating for the U. S. since 1917. The rating of the government’s ability to repay its debts is no longer at the highest level for all of the major ratings agencies

29. May 20th– Canadian inflation slowed below Bank of Canada target

The Canadian Consumer Price Index (CPI) rose 1.7% year-over-year in April, down from a 2.3% increase in March. The lower inflation rate was led by energy prices that fell by 12.7% in April, after a 0.3% decline in March. However, inflation for food purchased in stores increased to 3.8% in April, following a 3.2% increase in March. The Bank of Canada attempts to limit the long-run average inflation rate to 2%.

30. May 21st– Legislative progress drove markets downward

The U. S. House of Representatives passed a “big, beautiful bill” that the non-partisan Congressional Budget Office predicts will increase the federal deficit by $3.8 Trillion over the next decade. On Wednesday, after the House narrowly passed bill that brings multitrillion dollar tax and spending cuts, U. S. equity markets fell.

The increasing deficit coupled with higher interest rates linked to the lower credit rating will bring higher borrowing costs and, ultimately, contribute further to the federal deficit.

31. May 23rd– Canadian retail sales continued to increase

Retail sales increased for the fourth consecutive quarter as six of nine subsectors saw increases. The largest increases were seen at motor vehicle and parts dealers, while sales at gasoline stations and fuel vendors fell in response to lower prices.

32. May 26th– Tariff delay for EU moved markets higher

Equities jumped after President Trump announced two days after its introduction that a new 50% tariff on European Union imports would be delayed until July 9th.

Expect more uncertainty based on a new 50% U. S. tariff on steel and tit-for-tat countermeasures.

33. May 27th– King Charles delivered throne speech to Parliament

King Charles delivered the speech from the throne to open Parliament for the newly elected Liberal government under Prime Minister Mark Carney. The priorities to eliminate interprovincial trade barriers, develop diverse international trading partners, deliver a middle-class tax cut, increase housing, reduce tax on new homes, and manage immigration were reiterated.

34. May 28thand 29th– Uncertainty over U.S. tariffs continued

The U. S. Court of International Trade (USCIT) ruled that Trump did not have the authority to impose the program of tariffs, which sent stocks upward. After a prompt appeal by the administration, a federal appeals court placed a temporary hold on the USCIT ruling. Stocks declined in response to the continuation of restrictive trade tactics.

35. May 29thand 30th– Canadian employment fell while GDP maintained its pace

Canadian payroll employment decreased by 54,000 in March following a decline of 40,200 in February. On a year-over-year basis, payroll employment was up 32,800 despite the last two months of decline.

Canadian GDP increased 0.5% in the first quarter of 2025, the same pace as the fourth quarter of 2024. Increased exports of passenger vehicles (+16.7%), industrial machinery, equipment and parts (+12.0%) were driven by the looming threat of U. S. tariffs.

36. June 4th– Bank of Canada maintained interest rates

The Bank of Canada (BoC) held interest rates unchanged for the second consecutive decision. The policy interest rate, the Canadian overnight rate, was kept at 2.75%. The BoC announcement included, “With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, Governing Council decided to hold the policy rate.”

37. June 5th– European Central Bank lowered rates

In contrast to the BoC, the European Central Bank lowered its interest rates by 0.25% as inflation hovers around the Governing Council’s 2% medium-term target.

38. June 6th– Jobs reports from U.S. and Canada showed employment waning

The Bureau of Labor Statistics reported its Employment Situation Summary, showing nonfarm payroll employment increased by 139,000 in May, and the unemployment rate was unchanged at 4.2%t. The average monthly gain over the last 12 months has been 149,000, slightly more than the U.S. job growth in May.

StatsCan announced that employment was little changed in May (+8,800). The employment rate held steady at 60.8%t, and the unemployment rate rose 0.1 percentage points to 7.0% From October 2024 to January 2025 Canadian employment increased by 211,000, but there has been virtually no additional employment in the last four months.

39. June 12th–Rising tensions in the Middle East affected market performance

Israel’s attack on Iran’s nuclear installations and military leadership, and Iran’s predictable response caused stocks, oil and gold to react. Stocks were down sharply the next day, except for energy stocks as oil jumped, as did gold.

40. June 18th– Federal Reserve continued its wait-and-see approach

The U. S. Federal Reserve chose to maintain interest rates at their current levels. The statement included, “The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. Uncertainty about the economic outlook has diminished but remains elevated. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%t.”

41. June 22nd– U.S. bombed Iran

Over the weekend, as tensions continued to rise, President Trump executed a three-site bombing raid on Iran. The destruction of Iran’s nuclear capabilities was the goal. Oil prices have risen about 10% recently due to the conflict with Iran. A reduction in Iran’s oil exports or production in the Middle East caused by U.S. actions will harm China directly, and further strain relations with the U.S.

Two days later President Trump announced a ceasefire between Israel and Iran.

42. June 24th– Canadian inflation stayed below Bank of Canada goal

The Consumer Price Index (CPI) rose 1.7%t on a year-over-year basis in May, matching April’s rate. On a monthly basis, the CPI rose 0.6% in May. A smaller price increase for rent and a decline in travel tours put downward pressure on the CPI in May. Excluding energy, the CPI rose 2.7% in May, compared with 2.9%t in April.

43. June 26thand 27th– U.S. and Canadian Gross Domestic Product fell

American GDP decreased at an annual rate of 0.5% in the first quarter of 2025. In the fourth quarter of 2024, before President Trump started a global trade war, GDP increased 2.4.

Canadian GDP edged down 0.1% in April, following a 0.2% increase in March. Goods producing industries were down 0.6% in April, with the manufacturing sector accounting for nearly all the decline. Services-producing industries were up 0.1% in April. StatsCan and GDP

44. June 27th– U.S. inflation rose slightly above Federal Reserve’s goal

Personal income fell $109.6 Billion and disposable personal income decreased $125.0 Billion in May. The Personal Consumption Expenditures (PCE) price index, the Federal Reserve’s primary inflation indicator, for May increased 2.3% on an annualized basis. Excluding food and energy, Core PCE, increased 2.7% from one year ago.

45. June 27thand 30th– Tariff and trade negotiations between Canada and the U.S. continued

On Friday Trump suspended all trade and tariff negotiations with Canada in retaliation to Canada’s Digital Services Tax, which was cancelled on Monday, restarting trade talks.

46. July 3rd– Trade balances narrowed and widened

StatsCan reported that Canada’s merchandise trade deficit with the world narrowed from a record $7.6 Billion in April to $5.9 Billion in May. Exports to the U. S. (-0.9%) were down for a fourth consecutive month. Exports to countries other than the United States rose 5.7% in May to reach a record high of $47.6 Billion, the third consecutive monthly high.

The U. S. trade balance increased more than 18% to $71.5 Billion in May (up from $60.3 Billion in April) as exports fell as reported by the Bureau of Economic Analysis release. Imports also fell, but by a smaller percentage than exports. In May, the largest trade deficits in billions were with Mexico ($17.1), Vietnam ($14.9) and China ($14.0).

47. July 3rd– U.S. job growth in June hit the average

The U.S. Bureau of Labor Statistics reported that total nonfarm payroll employment increased by 147,000 in June, higher than expectations and just below the 12-month average of 146,000.

48. July 8th– “Big Beautiful Bill” moved markets lower as debt grows higher

Some of the downturn can be attributed to the approval and signing into law Trump’s “big, beautiful budget bill”. Projections from the Congressional Budget Office have deficits increasing by $3.3 Trillion over the next decade.

49. July 10th– Trade war continued with new letters from the American president

Tariff letters were sent by President Trump to major trading partners. “The resulting uncertainty is preventing companies and countries from making plans as the rule so global commerce give way to a state of chaos” as reported by a NY Times article. Canada and the U.S. had been negotiating toward an agreement before a deadline in July 21stuntil Trump sent a letter with a 35% tariff and a new deadline of August 1st.

50. July 11th– Canadian jobs growth surprised analysts

StatsCan released employment data for June. Expectations were for little change, however the Canadian economy surprised analysts by adding 83,000 jobs and unemployment fell 0.1% to 6.9%. This was the first increase in employment since January. The unemployment rate had increased for three consecutive months before the decrease in June.

51. July 15th– Inflation data from Canada and the U.S.

Canada’s Consumer Price Index (CPI) rose 1.9% on a year-over-year basis in June, up from a 1.7% increase in May. On a monthly basis, prices rose 0.1% in June.

The Bureau of Labor Statistics (BLS) reported that consumer price increases have accelerated in response to President Trump’s trade war and tariffs. In June, prices have risen 2.7% on a year-over-year basis, the same measure in May was 2.4%. Over the course of the month of June, prices rose 0.3%, a significant increase from May’s monthly inflation of 0.1%.

52. July 22nd– Magnificent Seven performance moves indexes higher

The TSX, S&P 500 and NASDAQ reached new all-time highs, and the Dow sat just 0.2% or just 112 points below its closing record of 45,014 reached back in December. The TSX and S&P 500 have risen 7% & 9%, respectively, since mid-June. Some instability may present itself this week as large trade deadlines loom, interest rate announcements await and corporate earnings from the Magnificent Seven arrive.

53. July 30th– Bank of Canada and Federal Reserve held rates steady

The Bank of Canada held its policy interest rate unchanged on Wednesday morning. It was the third consecutive interest rate decision that held rates firm at 2.75%. The Canadian economy has shown resilience despite the threats of American tariffs. Inflation has not responded as favourably. Since it appears that the U. S. president will not return to more open trade conditions, and will impose tariffs and other restrictions, the Bank of Canada has not, yet taken steps to stimulate the economy. The Bank made projections based on three scenarios: tariffs in place as of July 27th, an escalation in tariffs, and a de-escalation in tariffs.

The Federal Reserve held its federal funds rate unchanged at a range of 4.25 to 4.5%. The announcement included, “…recent indicators suggest that growth of economic activity moderated in the first half of the year. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.” All but two of the Governors voted in favour of maintaining rates at the current level.

54. July 31st– Canadian employment and economic growth move in different directions

On Thursday, StatsCan released jobs data for May showing that “payroll employment” increased by 15,300 in May, a slight increase from April’s 14,600. Over the past year payroll employment has increased 43,300 as of May.

Canadian Gross Domestic Product edged downward by 0.1% in May, the second consecutive month of decline. Goods producing industries like mining, quarrying and oil and gas extraction, while manufacturing expanded. Services sectors were unchanged overall. StatsCan and GDP

55. August 1st– Trump’s tariffs arrived

To begin the month, 35% tariffs were imposed on Canadian imports to the U.S. as negotiations continue. Talks or communication was not ongoing at the highest level between Prime Minister Carney and President Trump when the tariffs came into force. Prime Minister Carney has indicated that negotiations with the U.S. president will resume when appropriate.

The month began with a disappointing Employment Situation Summary that caused President Trump to fire the chief statistician at the Bureau of Labor Statistics. Trump has been calling for an interest rate reduction, and the economy’s poor job performance could trigger a rate drop.

56. August 5th– trade deficits affected by threatened and enacted tariffs

Canada’s trade deficit continued to widen and reached its second highest monthly level at $5.9 Billion. Imports grew faster than exports as inbound shipments of high-value oil equipment arrived in June. Exports to the U.S. have fallen to 70% of total exports, compared with 83% in June 2024.

The Bureau of Economic Analysis announced that June’s U. S. trade deficit shrank 16% to $60.2 Billion as exports eased 0.5% (-$1.3Billion) and imports fell 3.7% (-12.8Billion) compared to May. The trade deficit reached its lowest level in 2 years as the trade gap with China and imports of consumer goods dropped sharply.

57. August 7th– China’s exports surged to skirt U.S. tariffs

China’s exports increased more than expected in July. Shipments sent to other countries that often forward Chinese goods onto the U. S. jumped. Shipments directly to the U.S. fell more than 20%. Overall, China’s exports grew by 7.2% compared with July 2024.

58. August 8th– Canadian employment fell dramatically, U.S. CPI rose

Canadian employment declined by 41,000 jobs in July as reported by StatsCan Labour Force Survey after an increase of 83,000 in June. The employment rate fell 0.2% to 60.7% and the unemployment rate was unchanged at 6.9%. Analysts expected employment to increase by 13,500 and unemployment to tick up to 7.0%. The employment decline was concentrated among youth aged 15 to 24 (-34,000). The industries that lost the most jobs were information, culture and recreation (-29,000) and construction (-22,000).

59. August 11th– China’s tariffs given 90-day reprieve

President Trump signed a 90-day extension delaying the introduction of 145% tariffs on Chinese imports, and China delayed its retaliatory tariffs of 125% on U.S. imports. The existing tariffs on imports from and exports to China are 30% and 10%, respectively.

60. August 12th– U.S. inflation may not delay Fed rate cuts

The CPI increased 0.2% for the month and 2.7% on a year-over-year basis. Core CPI, which excludes more volatile food and energy price changes, increased 0.3% for the month and 3.1% compared to last year. Core inflation rose more rapidly in July than it has in the past five months. With delays and renegotiations, July prices do not yet reflect all the effects of threatened and implemented tariffs, suggesting that inflation could continue to increase in the coming months.

Many analysts believe the weakness in the employment situation will encourage the Federal Reserve to cut interest rates despite rising inflation in July. On the morning of the CPI announcement CME’s Fed Watch tool listed the probability of a rate cut on September 17that 94%.

61. August 14th– Producer inflation soared

The Bureau of Labor Statistics released the Producer Price Index (PPI) showing that wholesale prices jumped 0.9% in July, after holding steady in June and rising 0.4% in May. The year-over-year rate of producer inflation grew to 3.3% for July, the highest rate in 5 months when February’s PPI was 3.4%.

62. August 15th– Trump and Putin met in Alaska

U.S. President Donald Trump met with Russian leader Vladimir Putin in Alaska to discuss his war with Ukraine. President of Ukraine, Volodymyr Zelenskyy, was not invited to the summit meeting, whose exclusion drew the ire of NATO and the European Union leaders. The progress, if any, achieved from the summit has not materialized in a meaningful manner, yet.

63. August 28th– U.S. Gross Domestic Product revised upward

During the period of April through June the U.S. economy grew by 3.3%, better than the 3.0 estimated initially. Imports subtract from GDP total in the calculation, and after stockpiling before tariffs were introduced, imports in the latter stages of the quarter fell by nearly 30%, which propped up GDP numbers.

64. August 29th– Canadian economy shrank

StatsCan reported that Gross Domestic Product declined by 0.4% in the second quarter after rising 0.5% in the first quarter. The decline was driven by substantial reductions in exports (down 7.5% in Q2) and business investments in machinery and equipment. U.S. initiated tariffs and Canada’s response, and the underlying uncertainty caused by the trade conflict, created the environment for an economic slowdown.

65. August 29th– PCE inflation remained above goal, tariffs deemed illegal, and rates could fall

The Federal Reserve’s preferred inflation indicator, the Personal Consumption Expenditures (PCE) price index rose 2.6% over the past year, and core inflation that excludes food and gasoline rose 2.9%. Both are above the Fed’s goal of 2% showing tariffs imposed by Donald Trump have raised prices. Inflation has returned to February’s level, which had been falling until tariffs were announced.

A federal appeals court has declared that Trump’s tariffs are illegal after upholding a May ruling by the Court of International Trade. The tariffs will remain in place temporarily to allow a further appeal to the U.S. Supreme Court.

Also, despite the mixed economic news CME’s Fed Watch tool has increased the likelihood of a cut to the federal funds rate by the Federal Reserve on September 17th.

66. September 5th– Canadian and U.S. employment reported disappointing results

Canada’s Labour Force Survey showed that employment dropped by 66,000 in August after falling 41,000 in July. The employment decline in August was mostly part-time work (-60,000), and full-time employment was stable following a decline in July (-51,000).

“Total nonfarm payroll employment changed little in August (+22,000) and has remained largely unchanged since April” as reported by the U.S. Bureau of Labor Statistics ‘Employment Situation Summary (ESS) release for August. During the first 5 months of 2025 U.S. employment grew by an average 168,000 per month, which included 228,000 in March, which was prior to the announcement of tariffs on April 2nd.

67. September 5th– Prime Minister Carney announced economic recovery plan

Prime Minister Carney announced actions to strengthen the Canadian economy, reduce reliance on the U.S., and promote trade on a broader scale.

68. September 11th– U.S. CPI remained above goal

The Consumer Price Index (CPI) crept upward in August. The year-over-year consumer inflation rate was 2.9%, and the month-to-month increase was 0.4%. A month earlier in July, the annual rate was 2.7%. Core CPI, which excludes more volatile food and energy, climbed at an annual rate of 3.1%, and 0.3% for the month.

69. September 16th– Canadian CPI edged up in August, remained at goal

According to the StatsCan release, the year-over-year Consumer Price Index (CPI) increased 1.9% in August, up from a 1.7% increase in July. The CPI decreased 0.1% over the month of August.

70. September 17th– Bank of Canada and Federal Reserve lowered policy interest rates

Inflation at current levels does not pose a risk, and with economic growth and employment waning, the Bank of Canada lowered its policy interest rate on Wednesday morning. The interest rate charged between financial institutions and the Bank, the overnight rate, was lowered by 0.25 percent (25 basis points). Bank had last adjusted rates on March 12, 2025. The Bank’s statement indicated that “Canada’s GDP declined by about 1.5% in the second quarter, as expected, with tariffs and trade uncertainty weighing heavily on economic activity.”

The U.S. Federal Reserve took similar action to lower the federal funds rate to a range of 4 to 4.25%. The Fed’s statement began, “Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.”

71. September 26th– U.S. PCE confirmed inflation above goal rate

The Bureau of Economic Activity (BEA) reported that the Personal Consumption Expenditures price index (PCE), the Federal Reserve’s preferred inflation indicator, rose in August at 2.7% on a year-over-year basis. In July, prices rose 2.6%. The slight uptick in consumer inflation is unlikely to change the course of Federal Reserve interest rate policy. On September 17th, the Fed indicated that two additional rate cuts were possible in 2025.

72. September 26th– GDP rebounded in Canada and the U.S.

Gross Domestic Product (GDP) has been more resilient than expected in both the U.S. and Canada as reported by the latest announcements. Canada’s GDP grew 0.2% in July, the first increase in four months.

U.S. GDP grew at an annual rate of 3.8% in the second quarter as reported by the BEA’s “third estimate”.

73. September 30th– U.S. government shut down by budget battle

At midnight the U.S. federal government did not have funds to operate as the latest budget bill ended without a replacement. Despite the turmoil the S&P 500 reached a new record as equity markets believe the shutdown will be short-lived.

74. October 1st– U.S. government shut-down began

A government shutdown began after the U.S. Congress was unable to reach an agreement to extend funding to avoid the disruption of services and benefits. One of the casualties of the budget impasse was the scheduled Nonfarm Payroll Report from the Bureau of Labor Statistics. The payroll report is considered “the King of the Numbers” and is closely watched, along with interest rates and inflation, to inform traders.

75. October 1st– Bank of Canada released its logic on mid-September interest rate cut

The Bank of Canada released its Summary of Deliberations from its September 17th 0.25 point interest rate cut. Since the July Monetary Policy Report, “the global economy had proven resilient to increased U.S. tariffs in the first half of the year, there were increasing signs that economic growth was slowing.”

76. October 7th– Canada’s trade balance affected by U.S. tariffs

Prime Minister Carney and President Trump met in Washington to discuss several issues, including trade between the two countries as Canada’s trade surplus with the U. S. fell from $7.4 billion in July to $6.4 billion in August.

77. October 10th– Canada’s employment numbers rebounded

StatsCan released the latest employment report. Employment increased by 60,000 in September, after declining by more than a combined 100,000 in July and August. The unemployment rate was unchanged by 7.1%. The turnaround from job losses to growth and an increase above analyst expectations is a positive sign for the health of the Canadian economy despite the ongoing trade war and negotiations with the U.S.

78. October 16th– Market volatility peaked mid-month

The primary measure of volatility is the CBOE VIX Volatility Index. At the highest level since President Trump’s Liberation Day, the VIX peaked at 25.31, one week earlier it was 16.43. The calculation of VIX is complicated, however the 54% increase in one week indicates how quickly and dramatically volatility rose based on Trump’s trade war and the government shutdown. To better understand VIX, values below 20 represent stability, and values over 30 indicate greater market fear and uncertainty.

79. October 21st– Canada’s consumer inflation moved up by one-half percent

StatsCan announced that the Consumer Price Index (CPI) rose 2.4% on a year-over-year basis in September, up from a 1.9% increase in August. Economists had expected a rise of 2.2%. A slower decline in prices for gasoline and a larger increase in grocery prices conspired together to push the inflation rate higher. The Bank of Canada preferred inflation indicator set is Core CPI, which excludes food and energy. The three measures of Core CPI in September were 2.7%, 3.2% and 3.1%, with 3% as the goal.

80. October 23rd– Trump ended tariff negotiations with Canada, again

President Trump ended tariff negotiations on Thursday night in response to a campaign that includes a video advertisement that the Government of Ontario has been airing in the U.S. Trump has attributed the ad to Canada, not Ontario, which may have contributed to his decision to cease trade talks.

81. October 24th– U.S. consumer inflation moved upward

Despite the U.S. government shut down the Bureau of Labor Statistics released CPI data for September. On a seasonally adjusted consumer prices rose 0.3%, slightly below the 0.4% measured in August. On a year-over-year basis the all-items index rose 3% versus 2.9% in August.

82. October 29th– Bank of Canada and Federal Reserve cut rates

For the second consecutive announcement the Bank of Canada cut its overnight rate, which now sits at 2.25%. At the press conference, Governor Tiff Macklem concluded, “With ongoing weakness in the economy and inflation expected to remain close to the 2% target, Governing Council decided to cut the policy rate by 25 basis points.”

The U.S. Federal Reserve stated “Inflation has moved up since earlier in the year and remains somewhat elevated” as the government shutdown severely limited the dissemination of economic data. Nonetheless the Fed lowered the federal funds rate by 0.25% to a range of 3.75 to 4%.

83. October 30th– European Central Banks held rates unchanged

The European Central Bank decided to maintain its interest rates since their consumer inflation has settled around their 2% goal and employment has stabilized. The effects of the trade war on European economies are more muted than on North American economies.

84. November 4th– Federal Liberals tabled their budget in the House of Commons

Prime Minister Mark Carney introduced the first Canadian federal budget in 18 months. The promised 25% reduction in minimum RRIF withdrawals was not included. Bare trust reporting will finally begin in 2027 for year-ends of December 31, 2026, and later.

85. November 7th– Canadian employment bounced-back

The Labour Force Survey from StatsCan reported that employment increased by 67,000 in October and the unemployment rate declined by 0.2% to 6.9%. Wages have increased 3.5% (+ $1.27 to $37.06) on a year-over-year basis in October, following growth of 3.3% in September.

86. November 12th– Government shutdown ended

The longest government shutdown in U.S. history finally ended, and the reopening will take several weeks, if not months, to achieve.

87. November 14th– Effects of shutdown reduced likelihood of Fed rate cut

Unfortunately, the positive effect of reopening was tempered for investors. During the shutdown the Bureau of Labor Statistics missed reporting several key economic indicators, and it appears that several may never be reported. Missed reports in 2025 will prevent the interpretation of annualized trends in 2026 when year-over-year comparisons are impossible. Doubt has begun to rise whether the Federal Reserve has sufficient evidence to reduce interest rates. As of November 14th, CME’s Fed Watch tool indicated that the likelihood of a 0.25 point rate cut was slightly less than rates remaining unchanged.

88. November 17th– Canadian consumer inflation edged upward

StatsCan reported that the Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in October, slightly lower than the 2.4% increase in September. CPI fell due to lower gasoline prices and a slowing of price increases for groceries.

Canadian budget bill passes House vote

The House of Commons approved the 2025 budget bill, which was enabled by four abstentions and the support of Green Party MP, Elizabeth May, the vote passed 170-168.

89. November 20th– U.S. jobs added and finally returned to April levels

The U.S. Employment Situation Summary revealed that “total nonfarm payroll employment edged up by 119,000 in September but has seen little change since April. The unemployment rate changed little in September at 4.4%.

90. November 21st– Fed released its meeting minutes, and rate cuts have become less certain

The U.S. Federal Reserve released the minutes from its interest rate meeting of October 28-29 when the federal funds rate was reduced by 0.25%. Some committee members stated that lowering the rate could entrench inflation above the 2% goal and signal a reduced commitment to achieving price stability.

91. November 25th– More economic releases cancelled by U.S. administration

Three import indicators, jobs, inflation and GDP, have been delayed or cancelled with the now-ended government shutdown as the excuse for withholding data. The tariff scheme and mass deportations has reduced U. S. GDP by 7% as reported by one source, and consensus is growing that bad news is being withheld.

92. November 28th– Canadian GDP rebounds in Q3

“Real gross domestic product (GDP) rose 0.6% in the third quarter of 2025, after falling 0.5% in the second quarter” as reported by the StatsCan release on November 28th. The annualized GDP growth rate in the quarter was 2.6%.

93. December 5th– Canadian employment rose

Canadian “employment increased by 54,000 in November, driven by gains in part-time work” as reported by StatsCan’s Labour Force Survey. The unemployment rate fell 0.4% points to 6.5%. Although total employment was stagnant from January to August, employment has increased 181,000 over the last three months (September, October and November).

94. ADP reported 8th– ADP reported job losses

The U.S. Bureau of Labor Statistics jobs report has been delayed more than two weeks until December 16th, which is after the next Fed interest rate decision. Payroll processor, ADP, reported that private employers in the U. S. shed 32,000 jobs in November. Small businesses, which are sensitive to economic influences and sentiment, led the drop in employment.

95. December 5th– Canadian employment continued three-month rise

The Federal Reserve’s preferred inflation indicator, the Personal Consumption Expenditures price index, (PCE) was released. Both the overall PCE and Core PCE (excluding food and energy) increased 2.8% in September. Nearly all the increase in current-dollar personal consumption expenditures, $63 Billion of $65.1 Billion, reflected an increase in spending for services.

Both the Bank of Canada and Federal Reserve have mandates to control inflation and maximize employment. The Canadian Consumer Price Index sits is 2.2% on a year-over-year basis at the end of October, and the recent job gains suggest the Bank of Canada may hold rates steady. The lack of official employment data and slightly stale, yet better than expected inflation numbers have a Federal Reserve rate cut predicted as almost 90% certain.

96. ADP reported 8th – ADP reported job losses

The Bank of Canada kept the overnight rate at 2.25%. Controlling consumer inflation, one of the Bank’s major objectives, was achieved at 2.2% in October. The Bank’s rationale also included the Consumer Price Index (CPI) remained close to the 2% target, Canadian Gross Domestic Product that grew at an annualized rate of 2.6% in the third quarter, Canada’s labor market is improving with solid job gains in the last three months and a decline to the unemployment rate.

97. December 15th– Canadian consumer prices rose 2.2%

The Canadian Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in November, matching October’s result. Month-over-month in November, the CPI rose 0.1%. Prices for services rose more slowly, and grocery price inflation was the highest since the end of 2023, driven by beef and coffee prices that have risen 17.7% and 27.8%, respectively, in the last year.

98. December 16th– U.S. employment changed little

The BLS also reported the November’s Employment Situation Summary stating, “total nonfarm payroll employment changed little in November (+64,000) and has shown little net change since April.” The unemployment rate was 4.6% and was little changed from September. Again, no data was collected in October due to the federal government shutdown. Since November 2024 the number of unemployed persons has risen almost 10% to 7.8 million, and the number of people who want a job has risen over 1 million to 6.1 million over the same period. The Fed may increase its focus in this area.

99. December 18th– U.S. consumer inflation rose slightly

The Consumer Price Index in the United States increased 2.7% on a year-over-year basis. Over the two months from September to November 2025 the CPI rose 0.2%. The Bureau of Labor Statistics (BLS) did not collect or publish CPI inflation data for October 2025 “due to a lapse in appropriations.” Analysts are suggesting that a “tame inflation” rate could focus the Federal Reserve on maximizing employment. Although, the likelihood of a January rate-cut remained low, the possibility for a March cut is rising as reported by CME’s Fed Watch tool.

The European Central Bank kept its three key lending rates unchanged on Thursday. Its updated assessment confirmed that inflation should stabilize at the 2% target in the medium term.