July 2025 Market Recap

Last Month in the Markets: July 1st – 31st, 2025

What happened in July?

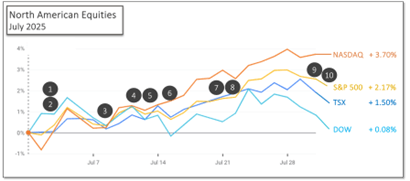

Equity indexes had a strong month. New all-time highs were achieved several times by the TSX, S&P 500, and NASDAQ, while the Dow came close. President Trump’s global trade war has yet to show widespread economic consequences. For now, tariffs either haven’t been implemented or haven’t been in place long enough to affect inflation, employment, or output.

Key Economic and Political Events in July

1. July 3 – Trade Balances Shift

StatsCan reported that Canada’s merchandise trade deficit narrowed from a record $7.6 billion in April to $5.9 billion in May. Exports to the U.S. declined for a fourth straight month, while exports to other countries rose 5.7%, reaching a record $47.6 billion.

In the U.S., the trade deficit increased by over 18% to $71.5 billion, driven by a sharper drop in exports compared to imports. The largest deficits were with Mexico, Vietnam, and China.

2. July 3 – U.S. Job Growth Meets Expectations

U.S. nonfarm payroll employment increased by 147,000 in June—slightly above expectations and nearly matching the 12-month average of 146,000.

3. July 8 – “Big Beautiful Budget Bill” Pressures Markets

Markets slipped after President Trump signed the “big, beautiful budget bill.” The Congressional Budget Office projects that this will add $3.3 trillion to deficits over the next decade.

4. July 10 – Tariff Letters Heighten Uncertainty

President Trump sent tariff warnings to major trade partners, causing market unrest. Canada and the U.S. were in negotiations before a new 35% tariff and deadline were announced, delaying progress toward an agreement.

5. July 11 – Canadian Employment Surges

StatsCan reported that Canada added 83,000 jobs in June, bringing unemployment down to 6.9%. This was the first employment increase since January, following three months of rising unemployment.

6. July 15 – Inflation Data Released

Canada’s CPI rose 1.9% year-over-year in June, up from 1.7% in May. Monthly inflation was 0.1%.

In the U.S., inflation accelerated to 2.7% annually in June (up from 2.4% in May), with monthly inflation rising to 0.3%. The increases are partly attributed to tariff-related cost pressures. Despite this, President Trump continued to call on the Federal Reserve to cut interest rates at the July 30th announcement.

7. July 21 – Bank of Canada Survey Reflects Business Caution

The Bank of Canada’s Q2 Business Outlook Survey, conducted in May, showed ongoing uncertainty due to tariffs. One-third of firms expected rising costs from the trade war, although fewer anticipated future negative impacts.

8. July 22 – “Magnificent Seven” Push Markets Higher

Strong performance from top companies helped push the TSX, S&P 500, and NASDAQ to new highs. The Dow was within 0.2% of its record. The TSX gained 7%, and the S&P 500 rose 9% since mid-June.

9. July 30 – Interest Rates Held Steady

The Bank of Canada kept its policy rate at 2.75% for the third straight time. The economy showed resilience, although inflation lagged. The Bank is preparing for multiple tariff-related scenarios.

The U.S. Federal Reserve also maintained its rate at 4.25% to 4.5%, citing moderate growth, low unemployment, solid labour markets, and somewhat elevated inflation. Only two Governors dissented.

10. July 31 – Canadian Jobs Up, GDP Down

StatsCan reported that payroll employment rose by 15,300 in May. Over the past year, it has increased by 43,300. However, GDP shrank by 0.1% in May, marking a second consecutive monthly decline. Goods-producing sectors declined, while manufacturing grew and service sectors remained flat.

Looking Ahead: August and Beyond

On August 1st, President Trump implemented a 35% tariff on Canadian imports not in compliance with the Canada-U.S.-Mexico Agreement (CUSMA). Prime Minister Mark Carney responded with disappointment and reaffirmed Canada’s commitment to the deal. Canadian officials promptly engaged with their Mexican counterparts to discuss cooperative trade actions.

Also on August 1st, the U.S. Bureau of Labor Statistics reported that only 73,000 jobs were added in July—half the 12-month average. Tariff uncertainty was cited as a key reason for delayed or canceled hiring. Trump responded by firing the BLS director.

Further, he renewed pressure on the Federal Reserve to cut rates and publicly questioned the tenure of Chair Jerome Powell. A Fed Governor resigned the same day, potentially signalling future changes in U.S. monetary policy leadership.

In contrast, Canadian monetary policy remains politically independent. The Bank of Canada’s next rate decisions are scheduled for September 19 and October 29. The U.S. Federal Reserve will announce its decisions around the same dates.

The direction of trade negotiations and monetary policy will continue to shape markets in Canada, the U.S., and globally.