November 2025 Market Recap

Last Month in the Markets: November 3rd – 28th, 2025

What happened in November?

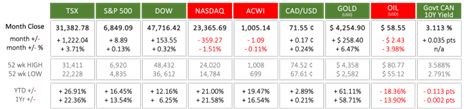

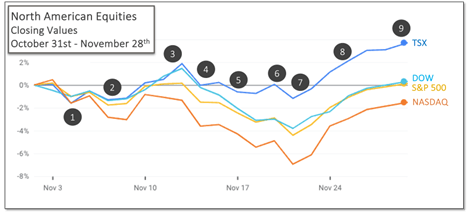

The final—and Thanksgiving-shortened—week of the month salvaged what had otherwise been a disappointing stretch for North American equity markets. The S&P 500 and Dow posted small but positive gains after rising more than 3% during the last week of November. The TSX climbed 4% in the same period and reached another all-time high.

Despite a strong final week, the NASDAQ remained approximately 1.5% below its level at the end of October, even after gaining nearly 5% over the four trading days.

Gold continued to hold most of its recent gains and remained up roughly 60% year-over-year. Oil prices continued to decline toward their 52-week lows as supply outpaced demand

Events that influenced markets in November included:

1. November 4 – Federal Liberals table their budget

Prime Minister Mark Carney introduced the first federal budget in 18 months. The anticipated 25% reduction in minimum RRIF withdrawals was not included. The budget allowed certain businesses to immediately expense investments in new facilities, confirmed that some small-corporation shares will become RDSP-eligible in 2027, and set bare trust reporting to begin in 2027 for year-ends of December 31, 2026, and later

2. November 7 – Canadian employment rebounds

Statistics Canada reported that employment rose by 67,000 in October and the unemployment rate declined by 0.2% to 6.9%. Average hourly wages increased 3.5% year-over-year to $37.06, following 3.3% growth in September.

U.S. air travel disrupted by shutdown

The U.S. government shutdown caused significant travel disruption, including the cancellation of roughly 1,400 flights and delays to more than 6,000 others across 40 major airports.

3. November 12 – U.S. government shutdown ends

The longest shutdown in U.S. history concluded, but officials cautioned that restoring full government operations could take weeks or even months.

4. November 14 – Shutdown impacts reduce odds of Fed rate cut

Key U.S. economic indicators were not released during the shutdown, and several may never be reported. Missing 2025 data will complicate year-over-year comparisons in 2026 and limit the Federal Reserve’s ability to assess economic trends. As of mid-November, market-based expectations suggested the likelihood of a quarter-point rate cut had fallen below the probability of no change.

5. November 17 – Canadian inflation edges lower

Statistics Canada reported that CPI rose 2.2% year-over-year in October, compared with 2.4% in September. Inflation eased due to lower gasoline prices and slower grocery price increases.

Canadian budget bill passes

The House of Commons approved the 2025 budget bill by a narrow 170–168 vote, enabled by four abstentions and the support of Green Party MP Elizabeth May.

6. November 20 – U.S. job growth returns to April levels

The U.S. Employment Situation Summary showed non-farm payrolls rose by 119,000 in September, but overall job levels have changed little since April. Gains occurred in health care, food services, and social assistance, while transportation, warehousing, and federal government employment declined. The unemployment rate held at 4.4%.

7. November 21 – Fed meeting minutes show reduced certainty on rate cuts

Minutes from the October 28–29 Federal Reserve meeting indicated that some policymakers were concerned that further rate cuts could entrench inflation above the 2% target. Market expectations for a December rate hold rose from about 50% to 60% over the week.

8. November 25 – More U.S. economic releases cancelled

Reports on jobs, inflation, and GDP were delayed or cancelled, with officials citing the recent shutdown. Some analysts estimate that tariffs and mass deportations have reduced U.S. GDP by as much as 7%, prompting concerns that negative economic data is being withheld.

9. November 28 – Canadian GDP rebounds in Q3

Real GDP increased 0.6% in Q3 2025 after declining 0.5% in Q2. Imports fell 2.2% while exports rose 0.2%, strengthening the trade balance. Growth was bolstered by higher crude oil and bitumen exports and increased government capital spending on weapons systems and hospitals. The annualized growth rate for the quarter was 2.6%.

Fed December rate cut expectations increase

Recent strength in Canadian data and limited U.S. data do not fully explain the late-month market rally. The Federal Reserve’s Beige Book indicated weakening employment and other softening economic conditions, leading market participants to expect an interest rate cut in December. Lower rates typically support both business activity and equity markets

What’s ahead for November and beyond?

Upcoming interest rate decisions by the Bank of Canada and the U.S. Federal Reserve—both scheduled for December 10—will likely drive market sentiment. Developments related to USMCA negotiations, tariff policy, and ongoing geopolitical tensions in the Middle East and Europe may also influence markets. As always, unexpected events tend to have the most significant—and often negative—impact.