October 2025 Market Recap

Last Month in the Markets: October 1st – 31st, 2025

What happened in October?

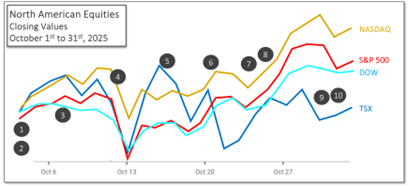

North American equity investors experienced strong performance in October, particularly those focused on U.S. indexes. While the TSX rose nearly one percent, American indexes advanced substantially more, with the NASDAQ gaining almost five percent.

This performance occurred alongside heightened uncertainty and mid-month volatility. Evidence of a “flight to safety” appeared on October 20th, when gold reached a peak closing price of $4,359 USD.

The spike in volatility, increased demand for gold, and temporary declines in equity values all followed the start of the U.S. government shutdown, which began before trading on Monday, October 13th.

Events that influenced markets in October included:

1. October 1st – U.S. Government Shutdown Began

The U.S. government shut down after Congress failed to reach an agreement to extend funding. The impasse disrupted services and benefits and delayed the release of the Nonfarm Payroll Report, a key economic indicator closely watched by traders.

2. October 1st – Bank of Canada Released Its Rationale for the Mid-September Rate Cut

The Bank of Canada published its Summary of Deliberations following the September 17th, quarter-point interest rate cut. Since the July Monetary Policy Report, the global economy had shown resilience to U.S. tariffs earlier in the year, but there were growing signs of slowing economic growth.

3. October 7th – Canada’s Trade Balance Affected by U.S. Tariffs

Prime Minister Carney met with President Trump in Washington to discuss trade and other issues. Canada’s trade surplus with the U.S. declined from $7.4 billion in July to $6.4 billion in August.

4. October 10th – Canadian Employment Rebounded

Statistics Canada reported that employment increased by 60,000 jobs in September, following combined losses of more than 100,000 in July and August. The unemployment rate remained steady at 7.1%. The rebound in employment, which exceeded analyst expectations, was a positive signal for the Canadian economy despite ongoing trade tensions with the U.S.

5. October 16th – Market Volatility Peaked Mid-Month

The CBOE Volatility Index (VIX), a key measure of market volatility, surged to 25.31—its highest level since President Trump’s “Liberation Day.” The VIX had been 16.43 just one week earlier, representing a 54% increase. Generally, a VIX below 20 indicates stability, while levels above 30 suggest significant market fear and uncertainty.

6. October 21st – Canadian Consumer Inflation Increased

Statistics Canada announced that the Consumer Price Index (CPI) rose 2.4% year-over-year in September, up from 1.9% in August and above economists’ expectations of 2.2%. A slower decline in gasoline prices and higher grocery costs contributed to the increase. The Bank of Canada’s preferred measure, Core CPI (which excludes food and energy), showed values of 2.7%, 3.2%, and 3.1%, averaging around the 3% target.

7. October 23rd – Trump Ended Tariff Negotiations with Canada

President Trump abruptly ended tariff discussions after reacting to a U.S. television advertisement funded by the Government of Ontario, which he mistakenly attributed to the federal Canadian government.

8. October 24th – U.S. Consumer Inflation Moved Upward

Despite the ongoing government shutdown, the U.S. Bureau of Labor Statistics released CPI data showing that consumer prices rose 0.3% in September (seasonally adjusted), slightly below the 0.4% increase in August. On a year-over-year basis, inflation reached 3.0%, up from 2.9% the previous month.

9. October 29th – Bank of Canada and Federal Reserve Cut Rates

Both the Bank of Canada and the U.S. Federal Reserve announced identical 0.25% (25 basis points) interest rate cuts.

The Bank of Canada’s overnight rate now stands at 2.25%. Governor Tiff Macklem noted that monetary policy cannot undo tariff-related damage but reaffirmed the Bank’s commitment to supporting the economy. The Bank cited a 1.6% GDP contraction in Q2, weak business investment, and modest labour-market recovery as reasons for the decision.

The U.S. Federal Reserve reduced its federal funds rate to a range of 3.75%–4.00%. The Fed noted that economic activity was expanding at a moderate pace but job gains had slowed and inflation remained elevated. Chair Powell emphasized that future rate cuts were not guaranteed and would depend on economic data—limited at the time due to the shutdown.

10. October 30th – European Central Bank Held Rates Steady

The European Central Bank decided to maintain current interest rates, citing stable inflation near its 2% target and steady employment levels. The impact of the global trade war on European economies remained less severe than in North America.

What’s ahead for November and beyond?

Global trade negotiations will continue to influence markets. U.S.–China relations will have worldwide implications, while ongoing U.S.–Canada discussions will directly affect domestic valuations, particularly for export-oriented industries.

Tariff impacts on inflation and employment will guide future central bank interest-rate decisions.

On Tuesday, November 4th, the Carney-led Liberal government is expected to introduce a new budget bill. Although the government has promised “no surprises,” investors will be watching closely for any policy changes that could affect markets.